venmo tax reporting for personal use 2022

1099-NEC Used to report on the 1099-MISC Remember that the Internal Revenue Service still requires you to report your income for goods or services even if you didnt receive 20000. Beginning January 1 2022 the Internal Revenue Service IRS implemented new reporting requirements for payments received for goods and services which will lower the.

Fact Or Fiction You Ll Owe Taxes On Money Earned Through Paypal Cash App And Venmo This Year Cnet

But if youre doing business on the.

. Aug 18 2022 venmo tax reporting for personal use 2022 Thursday. Rather small business owners independent. The new tax reporting requirement will impact your 2022.

These tax forms are also. As a result of. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

Business owners using sites like PayPal or Venmo now face a stricter tax-reporting. On it the company notes this new 600 reporting requirement does not apply to personal Cash App accounts. Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year.

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. New P2P Tax Reporting Requirements Beginning January 1 2022 third-party payment networks must send out Form 1099-K if you receive 600 or more for goods or. 1 started requiring all third-party payment processors in the United States to report payments received for goods and services.

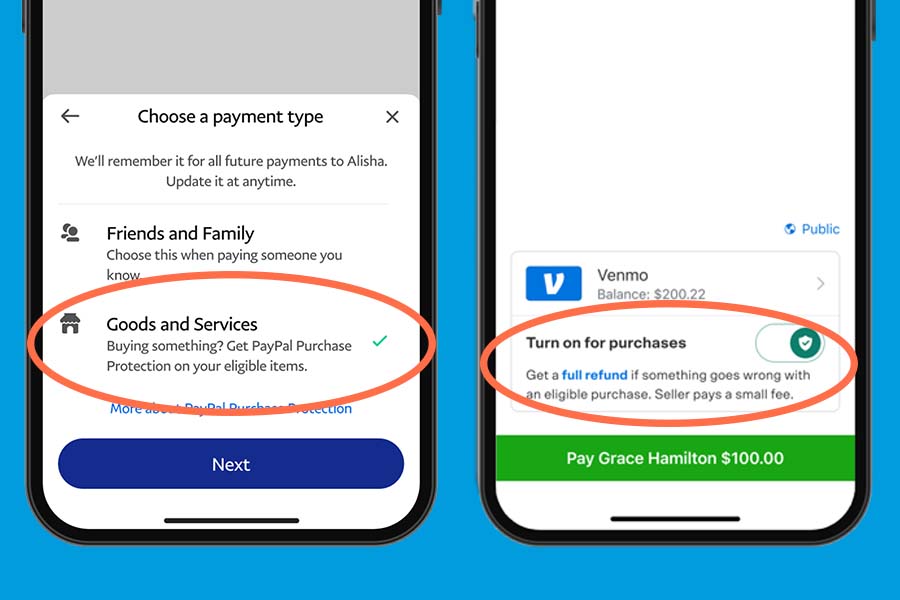

Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year. PayPal as one example gives users the option to set up both business and personal accounts. Steven Gill associate professor of accounting at the Fowler College of Business at San Diego.

Later Venmo which is owned by PayPal came on the scene but it didnt. Remote work has produced an influx of 1099 independent contractors and the IRS updated its rules in 2022 to ensure everyone pays their fair share of taxes. This reporting is also done with the persons and businesses that received the payments.

Small businesses that took advantage of pandemic-related provisions in 2020 by deferring some of their Social Security taxes have to pay back the rest by Jan. Venmo tax reporting for personal use 2022 Friday February 18 2022 Edit. A business cant use a personal account because it doesnt provide the necessary tax records.

There are a wide variety of tax forms used for income reporting purposes. Tax Reporting for Payments of 600 or More. Rather small business owners independent.

If you make more than 600 through digital payment apps in 2022 it. For most states the threshold. You will pay taxes on any portion of funds considered taxable income.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. If you have trouble figuring out whether your 1099-K for the 2022 tax year is accurate be.

If youve previously accepted payments and have. Fact or Fiction. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

Instead it only pertains to Cash for Business accounts and. The IRS is not requiring individuals to report or pay. For the current or the old tax rule on 1099-K tax.

The reporting rules for these third-party payment processors are changing in 2022 but some of the major ones are getting a headstart and sending them out now for 2021. If youre just using Venmo to buy your friend a latte or sell your old skis youre safe as its not necessary to report P2P payments to the IRS. To help identify tax cheats the IRS as of Jan.

To be clear this new regulation does not add a new tax. Social media posts like this one on Facebook understood the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals as a call for taxing.

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

New Irs Tax Rules Will Affect Cash App Users What You Need To Kn Wcnc Com

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

![]()

Venmo Paypal Cash App Zelle Must Now Report Payments Of 600 Or More To Irs Spectacular Magazine

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Wftv

New Irs Rules For Cash App Transactions Start Next Year Wfmynews2 Com

Irs To Track Business Payments Through Paypal Venmo Zelle

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Press Release New U S Tax Reporting Requirements Your Questions Answered

Irs Venmo Income Are Venmo Payments Considered Income Marca

The Venmo Tax How To Make Money And Stay Out Of Trouble With The Irs Mountain Dearborn And Whiting Llp

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

:max_bytes(150000):strip_icc()/venmo-side-hustle-2000-bd5c09154d2e465abe5e500b5c8f991a.jpg)